Your strategic partner dedicated to providing capital and expertise to teams developing sustainable infrastructure projects.

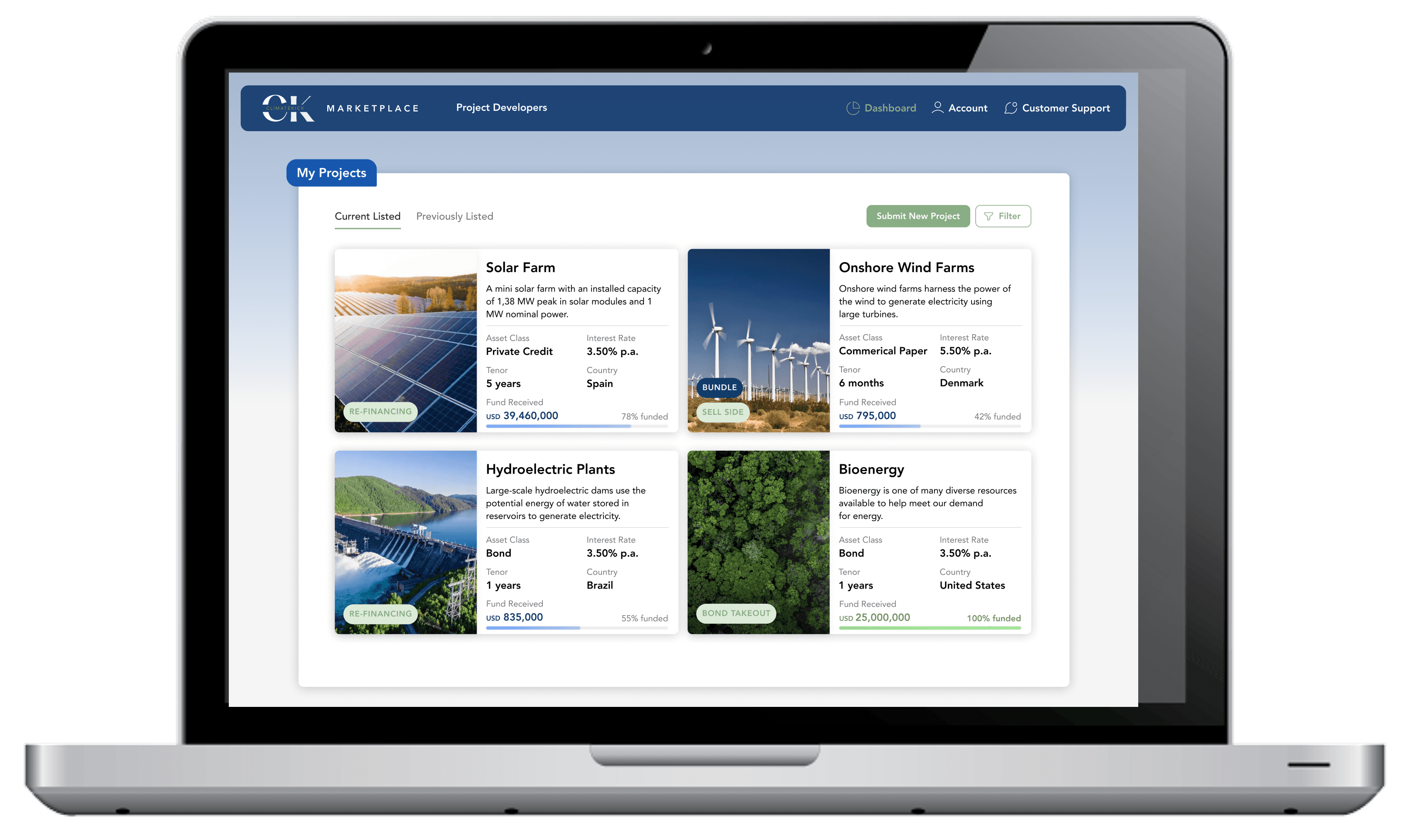

Green Investment Platform

Climate-related advisory

Service Description: Climate Kick goes beyond financial transactions by offering a range of climate-related services. We support mid-market developers, owner-operators, financiers, green banks, and digital asset funds to create the single source of truth that is necessary to maximize profitability, scale, and liquidity.

Benefits: Climate Kick empowers investors to not only invest in green assets but also manage their climate-related strategies effectively. They can transition their portfolios toward sustainability, access additional revenue streams through services like carbon credits, and gain valuable insights into the climate finance market.

Green taxonomies

Service Description: The Sustainability Performance Dashboard is a cutting-edge tool that allows investors to monitor and assess the financial and environmental performance of their investments based on Green Taxonomies on a global scale. It provides real-time data, KPI and insights on the sustainability outcomes of the green projects in which they've invested.

Benefits: Investors can make informed decisions based on both financial and sustainability metrics. They can track their investments' environmental impact and financial performance, thereby aligning their portfolios with eco-friendly objectives.

Cutting-Edge Technology for Accessibility

Comprehensive Approach to Climate Finance

Global Reach with a Local Touch

Securities are offered through Finalis Securities LLC Member FINRA / SIPC. Climate Kick LTD is not a registered broker-dealer, and Finalis Securities LLC and Climate Kick LTD are separate, unaffiliated entities. Finalis Securities LLC, Office of Supervisory Jurisdiction is located at 450 Lexington Ave, New York, NY 10017, 800-962-0418.

Finalis Privacy Policy | Finalis Business Continuity Plan | FINRA BrokerCheck | Finalis Form Customer Relationship Summary (“Form CRS”)

https://www.climate-kick.com/ (the "Climate Kick LTD Website") is a website operated by Climate Kick LTD. This website is for informational purposes only, is not an offer, solicitation, recommendation, or commitment for any transaction or to buy or sell any security or other financial product, and is not intended as investment advice or as a confirmation of any transaction. Products and services on this website may not be available for residents of certain jurisdictions. Please consult with a Finalis Securities’ registered representative regarding the product or service in question for further information. Investments involve risk and are not guaranteed to appreciate. Any market price, indicative value, estimate, view, opinion, data, or other information herein is not warranted as to completeness or accuracy, is subject to change without notice, and Climate Kick LTD along with Finalis Securities LLC accepts no liability for its use or to update it or keep it current.

Investing in private placements involves a high degree of risk. These investments may be illiquid, speculative, and subject to substantial restrictions on transferability. Investors may lose all or part of their investment and should only invest capital they can afford to lose. Prospective investors should conduct their own due diligence and consult with their legal, tax, and financial advisors prior to making any investment decision. For your reference, Finalis’ Form CRS describes the services that we provide, how we are compensated, and other important information about Finalis Securities LLC.